What is Money Laundering?

Money laundering is the illegal process of making large amounts of money generated by a criminal activity, such as drug trafficking or terrorist funding, appear to have come from a legitimate source. The money from the criminal activity is considered dirty, and the process "launders" it to make it look clean.

Money laundering is a serious financial crime that is employed by white collar and street-level criminals alike.1? Most financial companies have anti-money-laundering (AML) policies in place to detect and prevent this activity.

KEY TAKEAWAYS

- Money laundering is the illegal process of making "dirty" money appear legitimate instead of ill-gotten.

-

Criminals use a wide variety of money laundering techniques to make illegally obtained funds appear clean. -

Online banking and cryptocurrencies have made it easier for criminals to transfer and withdraw money without detection. -

The prevention of money laundering has become an international effort and now includes terrorist funding among its targets. -

How Money Laundering Works - Money laundering is essential for criminal organizations that wish to use illegally obtained money effectively. Dealing in large amounts of illegal cash is inefficient and dangerous. Criminals need a way to deposit the money in legitimate financial institutions, yet they can only do so if it appears to come from legitimate sources.

Banks are required to report large cash transactions and other suspicious activities that might be signs of money laundering.

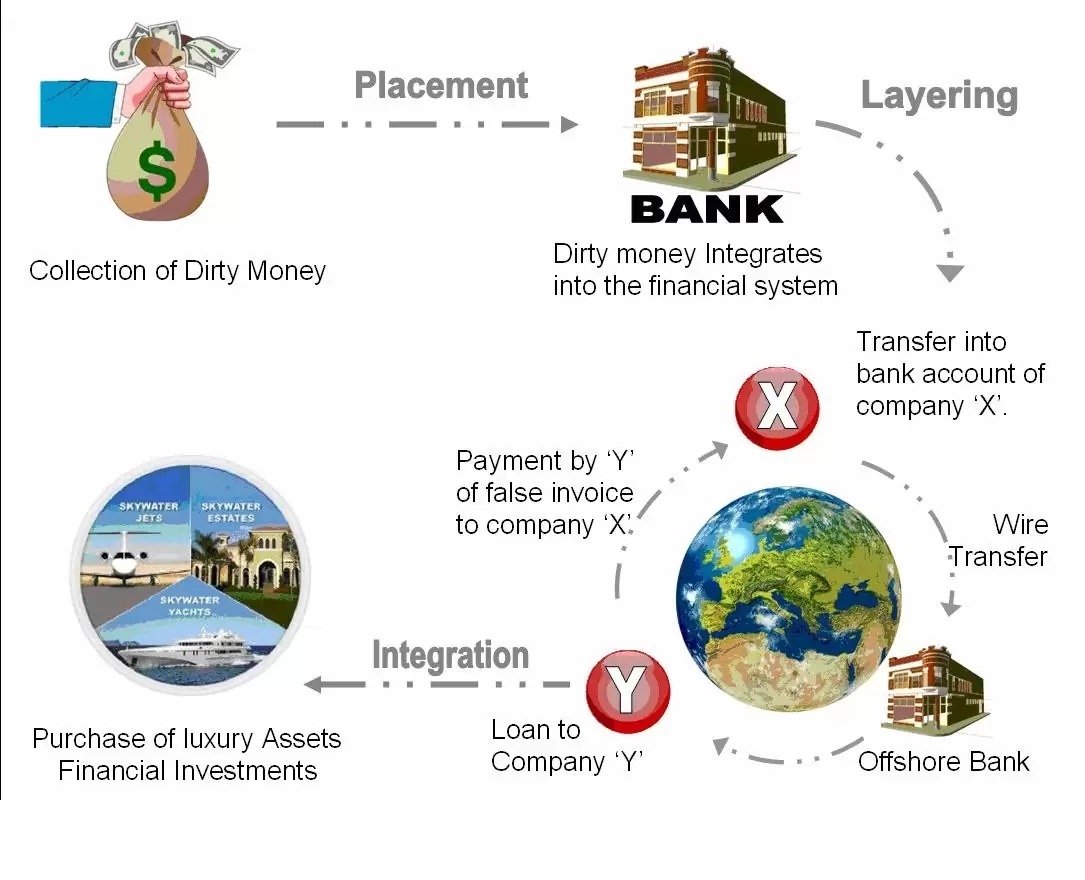

The process of laundering money typically involves three steps: placement, layering, and integration.

Placement puts the "dirty money" into the legitimate financial system.

Layering conceals the source of the money through a series of transactions and bookkeeping tricks.

In the final step, integration, the now-laundered money is withdrawn from the legitimate account to be used for whatever purposes the criminals have in mind for it.

There are many ways to launder money, from the simple to the very complex. One of the most common techniques is to use a legitimate, cash-based business owned by a criminal organization. For example, if the organization owns a restaurant, it might inflate the daily cash receipts to funnel illegal cash through the restaurant and into the restaurant's bank account. After that, the funds can be withdrawn as needed. These types of businesses are often referred to as "fronts."

Money Laundering Variants

In one common form of money laundering, called smurfing (also known as "structuring"), the criminal breaks up large chunks of cash into multiple small deposits, often spreading them over many different accounts, to avoid detection. Money laundering can also be accomplished through the use of currency exchanges, wire transfers, and "mules"—cash smugglers, who sneak large amounts of cash across borders and deposit them in foreign accounts, where money-laundering enforcement is less strict.

Other money-laundering methods involve investing in commodities such as gems and gold that can easily be moved to other jurisdictions, discreetly investing in and selling valuable assets such as real estate, gambling, counterfeiting; and using shell companies (inactive companies or corporations that essentially exist on paper only).

Electronic Money Laundering

The Internet has put a new spin on the old crime. The rise of online banking institutions, anonymous online payment services and peer-to-peer (P2P) transfers with mobile phones have made detecting the illegal transfer of money even more difficult. Moreover, the use of proxy servers and anonymizing software makes the third component of money laundering, integration, almost impossible to detect—money can be transferred or withdrawn leaving little or no trace of an IP address.

Money can also be laundered through online auctions and sales, gambling websites, and virtual gaming sites, where ill-gotten money is converted into gaming currency, then back into real, usable, and untraceable "clean" money.

The newest frontier of money laundering involves cryptocurrencies, such as Bitcoin. While not totally anonymous, they are increasingly being used in blackmail schemes, the drug trade, and other criminal activities due to their relative anonymity compared with more conventional forms of currency.

Anti-money-laundering laws (AML) have been slow to catch up to these types of cybercrimes, since most of the laws are still based on detecting dirty money as it passes through traditional banking institutions.

Preventing Money Laundering

Governments around the world have stepped up their efforts to combat money laundering in recent decades, with regulations that require financial institutions to put systems in place to detect and report suspicious activity. The amount of money involved is substantial. According to the United Nations Office on Drugs and Crime, global money laundering transactions account for roughly $800 billion to $2 trillion annually, or some 2% to 5% of global GDP.

In 1989, the Group of Seven (G-7) formed an international committee called the Financial Action Task Force (FATF) in an attempt to fight money laundering on an international scale. In the early 2000s, its purview was expanded to combating the financing of terrorism.

The United States passed the Banking Secrecy Act in 1970, requiring financial institutions to report certain transactions to the Department of the Treasury, such as cash transactions above $10,000 or any others they deem suspicious, on a suspicious activity report (SAR).3? The information the banks provide to the Treasury Department is used by the Financial Crimes Enforcement Network (FinCEN), which can share it with domestic criminal investigators, international bodies or foreign financial intelligence units.

While these laws were helpful in tracking criminal activity, money laundering itself wasn't made illegal in the United States until 1986, with the passage of the Money Laundering Control Act. Shortly after the 9/11 terrorist attacks, the USA Patriot Act expanded money-laundering efforts by allowing investigative tools designed for organized crime and drug trafficking prevention to be used in terrorist investigations.

The Association of Certified Anti-Money Laundering Specialists (ACAMS) offers a professional designation known as a Certified Anti-Money Laundering Specialist (CAMS). Individuals who earn CAMS certification may work as brokerage compliance managers, Bank Secrecy Act officers, financial intelligence unit managers, surveillance analysts and financial crimes investigative analysts.

SPONSORED

Managing Risk in an Upside Down World

Unpredictable market conditions can be scary, but you can still find opportunities in every major asset class. With CME Group, you can trade all asset classes, optimize across the trading cycle, and anlyize performance with industry-leading data solutions. Learn more about why CME Group is the world's leading derivaties marketplaces and get started now.

What is Money Laundering?

The goal of a large number of criminal acts is to generate a profit for the individual or group that carries out the act. Money laundering is the processing of these criminal proceeds to disguise their illegal origin. This process is of critical importance, as it enables the criminal to enjoy these profits without jeopardising their source.

Illegal arms sales, smuggling, and the activities of organised crime, including for example drug trafficking and prostitution rings, can generate huge amounts of proceeds. Embezzlement, insider trading, bribery and computer fraud schemes can also produce large profits and create the incentive to “legitimise” the ill-gotten gains through money laundering.

When a criminal activity generates substantial profits, the individual or group involved must find a way to control the funds without attracting attention to the underlying activity or the persons involved. Criminals do this by disguising the sources, changing the form, or moving the funds to a place where they are less likely to attract attention.

In response to mounting concern over money laundering, the Financial Action Task Force on money laundering (FATF) was established by the G-7 Summit in Paris in 1989 to develop a co-ordinated international response. One of the first tasks of the FATF was to develop Recommendations, 40 in all, which set out the measures national governments should take to implement effective anti-money laundering programmes.

How much money is laundered per year?

By its very nature, money laundering is an illegal activity carried out by criminals which occurs outside of the normal range of economic and financial statistics. Along with some other aspects of underground economic activity, rough estimates have been put forward to give some sense of the scale of the problem.

The United Nations Office on Drugs and Crime (UNODC) conducted a study to determine the magnitude of illicit funds generated by drug trafficking and organised crimes and to investigate to what extent these funds are laundered. The report estimates that in 2009, criminal proceeds amounted to 3.6% of global GDP, with 2.7% (or USD 1.6 trillion) being laundered.

This falls within the widely quoted estimate by the International Monetary Fund, who stated in 1998 that the aggregate size of money laundering in the world could be somewhere between two and five percent of the world’s gross domestic product. Using 1998 statistics, these percentages would indicate that money laundering ranged between USD 590 billion and USD 1.5 trillion. At the time, the lower figure was roughly equivalent to the value of the total output of an economy the size of Spain.

However, the above estimates should be treated with caution. They are intended to give an estimate of the magnitude of money laundering. Due to the illegal nature of the transactions, precise statistics are not available and it is therefore impossible to produce a definitive estimate of the amount of money that is globally laundered every year. The FATF therefore does not publish any figures in this regard.

How is money laundered?

In the initial – or placement – stage of money laundering, the launderer introduces his illegal profits into the financial system. This might be done by breaking up large amounts of cash into less conspicuous smaller sums that are then deposited directly into a bank account, or by purchasing a series of monetary instruments (cheques, money orders, etc.) that are then collected and deposited into accounts at another location.

After the funds have entered the financial system, the second – or layering – stage takes place. In this phase, the launderer engages in a series of conversions or movements of the funds to distance them from their source. The funds might be channelled through the purchase and sales of investment instruments, or the launderer might simply wire the funds through a series of accounts at various banks across the globe. This use of widely scattered accounts for laundering is especially prevalent in those jurisdictions that do not co-operate in anti-money laundering investigations. In some instances, the launderer might disguise the transfers as payments for goods or services, thus giving them a legitimate appearance.

Having successfully processed his criminal profits through the first two phases the launderer then moves them to the third stage – integration – in which the funds re-enter the legitimate economy. The launderer might choose to invest the funds into real estate, luxury assets, or business ventures.

Where does money laundering occur?

As money laundering is a consequence of almost all profit generating crime, it can occur practically anywhere in the world. Generally, money launderers tend to seek out countries or sectors in which there is a low risk of detection due to weak or ineffective anti-money laundering programmes. Because the objective of money laundering is to get the illegal funds back to the individual who generated them, launderers usually prefer to move funds through stable financial systems.

Money laundering activity may also be concentrated geographically according to the stage the laundered funds have reached. At the placement stage, for example, the funds are usually processed relatively close to the under-lying activity; often, but not in every case, in the country where the funds originate.

With the layering phase, the launderer might choose an offshore financial centre, a large regional business centre, or a world banking centre – any location that provides an adequate financial or business infrastructure. At this stage, the laundered funds may also only transit bank accounts at various locations where this can be done without leaving traces of their source or ultimate destination.

Finally, at the integration phase, launderers might choose to invest laundered funds in still other locations if they were generated in unstable economies or locations offering limited investment opportunities.

How does money laundering affect business?

The integrity of the banking and financial services marketplace depends heavily on the perception that it functions within a framework of high legal, professional and ethical standards. A reputation for integrity is the one of the most valuable assets of a financial institution.

If funds from criminal activity can be easily processed through a particular institution – either because its employees or directors have been bribed or because the institution turns a blind eye to the criminal nature of such funds – the institution could be drawn into active complicity with criminals and become part of the criminal network itself. Evidence of such complicity will have a damaging effect on the attitudes of other financial intermediaries and of regulatory authorities, as well as ordinary customers.

As for the potential negative macroeconomic consequences of unchecked money laundering, one can cite inexplicable changes in money demand, prudential risks to bank soundness, contamination effects on legal financial transactions, and increased volatility of international capital flows and exchange rates due to unanticipated cross-border asset transfers. Also, as it rewards corruption and crime, successful money laudering damages the integrity of the entire society and undermines democracy and the rule of the law.

What influence does money laundering have on economic development?

Launderers are continuously looking for new routes for laundering their funds. Economies with growing or developing financial centres, but inadequate controls are particularly vulnerable as established financial centre countries implement comprehensive anti-money laundering regimes.

Differences between national anti-money laundering systems will be exploited by launderers, who tend to move their networks to countries and financial systems with weak or ineffective countermeasures.

Some might argue that developing economies cannot afford to be too selective about the sources of capital they attract. But postponing action is dangerous. The more it is deferred, the more entrenched organised crime can become.

As with the damaged integrity of an individual financial institution, there is a damping effect on foreign direct investment when a country’s commercial and financial sectors are perceived to be subject to the control and influence of organised crime. Fighting money laundering and terrorist financing is therefore a part of creating a business friendly environment which is a precondition for lasting economic development.

What is the connection with society at large?

The possible social and political costs of money laundering, if left unchecked or dealt with ineffectively, are serious. Organised crime can infiltrate financial institutions, acquire control of large sectors of the economy through investment, or offer bribes to public officials and indeed governments.

The economic and political influence of criminal organisations can weaken the social fabric, collective ethical standards, and ultimately the democratic institutions of society. In countries transitioning to democratic systems, this criminal influence can undermine the transition. Most fundamentally, money laundering is inextricably linked to the underlying criminal activity that generated it. Laundering enables criminal activity to continue.

How does fighting money laundering help fight crime?

Money laundering is a threat to the good functioning of a financial system; however, it can also be the Achilles heel of criminal activity.

In law enforcement investigations into organised criminal activity, it is often the connections made through financial transaction records that allow hidden assets to be located and that establish the identity of the criminals and the criminal organisation responsible.

When criminal funds are derived from robbery, extortion, embezzlement or fraud, a money laundering investigation is frequently the only way to locate the stolen funds and restore them to the victims.

Most importantly, however, targeting the money laundering aspect of criminal activity and depriving the criminal of his ill-gotten gains means hitting him where he is vulnerable. Without a usable profit, the criminal activity will not continue.

What should individual governments be doing about it?

A great deal can be done to fight money laundering, and, indeed, many governments have already established comprehensive anti-money laundering regimes. These regimes aim to increase awareness of the phenomenon – both within the government and the private business sector – and then to provide the necessary legal or regulatory tools to the authorities charged with combating the problem.

Some of these tools include making the act of money laundering a crime; giving investigative agencies the authority to trace, seize and ultimately confiscate criminally derived assets; and building the necessary framework for permitting the agencies involved to exchange information among themselves and with counterparts in other countries.

It is critically important that governments include all relevant voices in developing a national anti-money laundering programme. They should, for example, bring law enforcement and financial regulatory authorities together with the private sector to enable financial institutions to play a role in dealing with the problem. This means, among other things, involving the relevant authorities in establishing financial transaction reporting systems, customer identification, record keeping standards and a means for verifying compliance.

Should governments with measures in place still be concerned?

Money launderers have shown themselves through time to be extremely imaginative in creating new schemes to circumvent a particular government’s countermeasures. A national system must be flexible enough to be able to detect and respond to new money laundering schemes.

Anti-money laundering measures often force launderers to move to parts of the economy with weak or ineffective measures to deal with the problem. Again, a national system must be flexible enough to be able to extend countermeasures to new areas of its own economy. Finally, national governments need to work with other jurisdictions to ensure that launderers are not able to continue to operate merely by moving to another location in which money laundering is tolerated.

What about multilateral initiatives?

Large-scale money laundering schemes invariably contain cross-border elements. Since money laundering is an international problem, international co-operation is a critical necessity in the fight against it. A number of initiatives have been established for dealing with the problem at the international level.

International organisations, such as the United Nations or the Bank for International Settlements, took some initial steps at the end of the 1980s to address the problem. Following the creation of the FATF in 1989, regional groupings – the European Union, Council of Europe, Organisation of American States, to name just a few – established anti-money laundering standards for their member countries. The Caribbean, Asia, Europe and southern Africa have created regional anti-money laundering task force-like organisations, and similar groupings are planned for western Africa and Latin America in the coming years.

Who can I contact if I suspect a case of money laundering?

The FATF is a policy-making body and has no investigative authority. In respect to investigating a company and persons involved in money laundering, individuals need to contact their local investigative authorities.

17kshu – I stumbled on this site via a link, quite intriguing layout overall.

3e7r – Checkout process was smooth, didn’t face any odd errors at all.

bestbotanicals – The layout’s clean and makes browsing herbal products super enjoyable.

7x084yko.xyz – The color scheme is subtle and gentle on the eyes, nice choice.

sh576.xyz – Some images didn’t load for me, hope those get fixed soon.

Для жителей северной столицы теперь доступна профессиональная клининг квартиры санкт петербург, выполняемая высококвалифицированным персоналом.

Уборка квартир в СПб должна проводиться регулярно для поддержания чистоты и гигиены. Это связано с тем, что Уборка квартир в Санкт-Петербурге может быть выполнена как самостоятельно, так и с привлечением профессиональных услуг.

6789138a.xyz – A few broken images here and there, hopefully they’ll be fixed.

196v5e63 – Mobile version fits perfectly on screen without any layout issues.

sj440.cc – The homepage looked sharp, got me curious to dig deeper right away.

5581249.cc – The navigation is okay, but a clearer menu would help.

sj256.cc – Menu layout is intuitive, helps me find what I need fast.

mydiving – The site layout feels calm and organized, perfect for easy reading.

a6def2ef910.pw – Some broken links appeared, hope the admin fixes those soon.

J’apprecie enormement 1xbet Casino, on dirait une energie de jeu irresistible. La gamme de jeux est tout simplement phenomenale, avec des machines a sous modernes et captivantes. Les agents sont toujours disponibles et efficaces, repondant en un clin d’?il. Les retraits sont ultra-rapides, occasionnellement davantage de recompenses seraient bienvenues. Globalement, 1xbet Casino ne decoit jamais pour les adeptes de sensations fortes ! En bonus le site est concu avec dynamisme, ce qui intensifie le plaisir de jouer.

1xbet ru|

Ich finde absolut irre DrueGlueck Casino, man fuhlt einen verruckten Spielvibe. Die Spielauswahl im Casino ist gigantisch, mit einzigartigen Casino-Slotmaschinen. Die Casino-Mitarbeiter sind blitzschnell und top, sorgt fur sofortigen Casino-Support. Der Casino-Prozess ist klar und ohne Haken, trotzdem mehr Casino-Belohnungen waren der Hit. Insgesamt ist DrueGlueck Casino eine Casino-Erfahrung, die rockt fur die, die mit Stil im Casino wetten! Ubrigens die Casino-Seite ist ein grafisches Meisterwerk, einen Hauch von Wahnsinn ins Casino bringt.

drueckglueck bonus code|

J’adore sans reserve 1xbet Casino, ca ressemble a une aventure pleine de frissons. La gamme de jeux est tout simplement phenomenale, incluant des slots de pointe. Le support est ultra-reactif et professionnel, joignable 24/7. Les gains sont verses en un temps record, cependant les promotions pourraient etre plus genereuses. Pour conclure, 1xbet Casino ne decoit jamais pour les adeptes de sensations fortes ! En bonus le site est concu avec dynamisme, ajoute une touche de raffinement a l’experience.

1xbet mobile download|

Je suis totalement envoute par Cresus, on ressent une energie magique. Les options sont vastes et envoutantes, offrant des machines a sous a theme unique. Le personnel offre un suivi digne d’un palace, offrant des solutions claires et rapides. Les paiements sont securises et efficaces, neanmoins j’aimerais plus de bonus reguliers. Dans l’ensemble, Cresus est un joyau pour les joueurs pour les amateurs de casino en ligne ! Ajoutons que le site est elegant et bien concu, ce qui rend chaque session encore plus memorable.

cresus casino|

Je trouve completement fou Instant Casino, on dirait une tempete de fun. Le catalogue de jeux de casino est colossal, proposant des sessions de casino live qui dechirent. Les agents du casino sont rapides comme l’eclair, repondant en un flash. Les retraits au casino sont rapides comme un missile, par contre plus de tours gratos au casino ca serait ouf. Au final, Instant Casino c’est un casino de ouf a tester direct pour les pirates des slots de casino modernes ! En prime le site du casino est une tuerie graphique, donne envie de replonger dans le casino direct.

slotastic instant play casino|

J’adore l’univers de Cresus, on ressent une energie magique. Il y a une abondance de titres captivants, avec des slots modernes et immersifs. Le service client est royal, joignable via chat ou email. Les gains arrivent sans delai, de temps en temps les offres pourraient etre plus genereuses. Globalement, Cresus offre une experience grandiose pour les fans de jeux modernes ! Notons aussi le design est somptueux et captivant, facilite une immersion totale.

cresus prive|

J’adore a fond Instant Casino, ca donne une energie de casino survoltee. La selection de titres de casino est dingue, comprenant des jeux de casino tailles pour les cryptos. Le crew du casino assure un suivi de ouf, garantissant un support de casino direct et efficace. Les paiements du casino sont fluides et securises, mais bon les offres de casino pourraient etre plus genereuses. Au final, Instant Casino est un spot de casino a ne pas rater pour ceux qui kiffent parier dans un casino style ! A noter aussi l’interface du casino est fluide et ultra-cool, donne envie de replonger dans le casino direct.

instant payid withdrawal casino australia|

Je suis accro a Instant Casino, on dirait une tempete de fun. La selection de titres de casino est dingue, avec des slots de casino modernes et immersifs. Le support du casino est dispo 24/7, repondant en un flash. Les gains du casino arrivent a la vitesse lumiere, par contre plus de tours gratos au casino ca serait ouf. Bref, Instant Casino offre une experience de casino inoubliable pour les pirates des slots de casino modernes ! Et puis la navigation du casino est simple comme un jeu d’enfant, ajoute un max de swag au casino.

instant casino|

0238.org – Overall makes a good impression, I’ll revisit to see updates.

21009.xyz – On mobile it mostly works, though some elements shift oddly.

00381.xyz – Load speed is acceptable, though some pages felt sluggish at times.

other2.club – Could use more padding in text areas, but overall feels solid.

i1oxj – The design looks clean and modern, very comfortable to use.

1cty – Everything I clicked opened fast, browsing felt very seamless overall.

deallegria – Navigation is simple and intuitive, I found things easily.

worldloans – Overall it’s a smooth, simple, and pleasant site to use.

fhkaslfjlas – Feels well-optimized, pages transition quickly without any problems.

jekflix – Everything ran smoothly for me, no slowdowns or errors happened.

mizao0 – Overall a simple, clear, and pleasant site to browse.

v1av7 – Navigation felt very straightforward, I found sections easily here.

v1av2 – Navigation is straightforward, I didn’t run into any confusion.

Helpful info. Fortunate me I discovered your site by chance, and I’m surprised why this twist of fate did not took place in advance! I bookmarked it.

aabb49 – No immediate glitches or technical errors.

J’apprecie enormement Betzino Casino, on dirait une experience de jeu electrisante. La gamme de jeux est tout simplement phenomenale, offrant des sessions de casino en direct immersives par Evolution Gaming. Le personnel offre un accompagnement rapide et efficace, garantissant une aide immediate. Le processus de retrait est simple et fiable avec un maximum de 5000 € par semaine, bien que les offres pourraient etre plus genereuses. Globalement, Betzino Casino est un incontournable pour les joueurs en quete d’adrenaline ! En bonus la navigation est intuitive sur mobile via iOS/Android, ce qui amplifie le plaisir de jouer.

betzino casino no deposit bonus|

J’adore le show de Impressario, ca donne une energie de star absolue. La gamme est une vraie constellation de fun, avec des slots qui brillent de mille feux. Le crew assure un suivi etoile, garantissant un support direct et brillant. Les gains arrivent a la vitesse de la lumiere, par contre des bonus plus reguliers ce serait la classe. Dans le fond, Impressario garantit un show de fun epique pour ceux qui kiffent parier avec style ! Et puis la navigation est simple comme une melodie, ajoute un max de charisme.

impressario casino review|

Je kiffe a fond Impressario, il propose un show de jeu hors norme. Le catalogue est un festival de titres, incluant des jeux de table pleins de panache. L’assistance est une vraie performance de pro, avec une aide qui fait mouche. Les transactions sont simples comme un refrain, de temps en temps j’aimerais plus de promos qui envoutent. Bref, Impressario garantit un show de fun epique pour les amateurs de slots qui brillent ! Cote plus le design est une explosion visuelle, booste l’immersion a fond.

impressario casino no deposit bonus|

66se – The site loads quickly without delays.

2kgq – Scrolling is fluid, nothing laggy or glitchy during my visit.

tiantianyin4 – Mobile browsing is smooth, everything fits the screen nicely.

tstyhj – Very straightforward and easy-to-use site, I enjoyed checking it.

93r – Interface feels bold, but cohesion and narrative are still weak.

nnvfy – The interface feels smooth and lightweight during navigation.

fghakgaklif – A straightforward site, smooth experience from start to finish.

Автор статьи умело анализирует сложные концепции и представляет их в понятной форме.

J’apprecie enormement 7BitCasino, on dirait une experience de jeu electrisante. Le catalogue est incroyablement vaste, avec des machines a sous modernes et captivantes. Le personnel offre un accompagnement irreprochable, avec un suivi de qualite. Les retraits sont ultra-rapides, par moments j’aimerais plus d’offres promotionnelles, afin de maximiser l’experience. Globalement, 7BitCasino offre une experience de jeu securisee et equitable pour ceux qui aiment parier avec des cryptomonnaies ! En bonus la navigation est intuitive et rapide, ajoute une touche de raffinement a l’experience.

7bitcasino reviews|

Je trouve completement brulant Celsius Casino, il propose une aventure de casino qui fait monter la temperature. Il y a un torrent de jeux de casino captivants, avec des machines a sous de casino modernes et envoutantes. L’assistance du casino est chaleureuse et efficace, assurant un support de casino immediat et flamboyant. Les gains du casino arrivent a une vitesse torride, quand meme des bonus de casino plus frequents seraient torrides. En somme, Celsius Casino offre une experience de casino incandescente pour ceux qui cherchent l’adrenaline du casino ! Bonus l’interface du casino est fluide et eclatante comme une flamme, amplifie l’immersion totale dans le casino.

celsius casino no deposit bonus|

Je kiffe grave Gamdom, ca donne une energie de jeu demente. La selection est totalement dingue, offrant des machines a sous ultra-cool. L’assistance est au top du top, offrant des reponses qui petent. Les paiements sont fluides et blindes, par contre j’aimerais plus de promos qui defoncent. En gros, Gamdom est une plateforme qui dechire tout pour les accros aux sensations extremes ! Cote plus la plateforme claque avec son look de feu, booste l’immersion a fond les ballons.

gamdom deneme bonusu|